carried interest tax reform

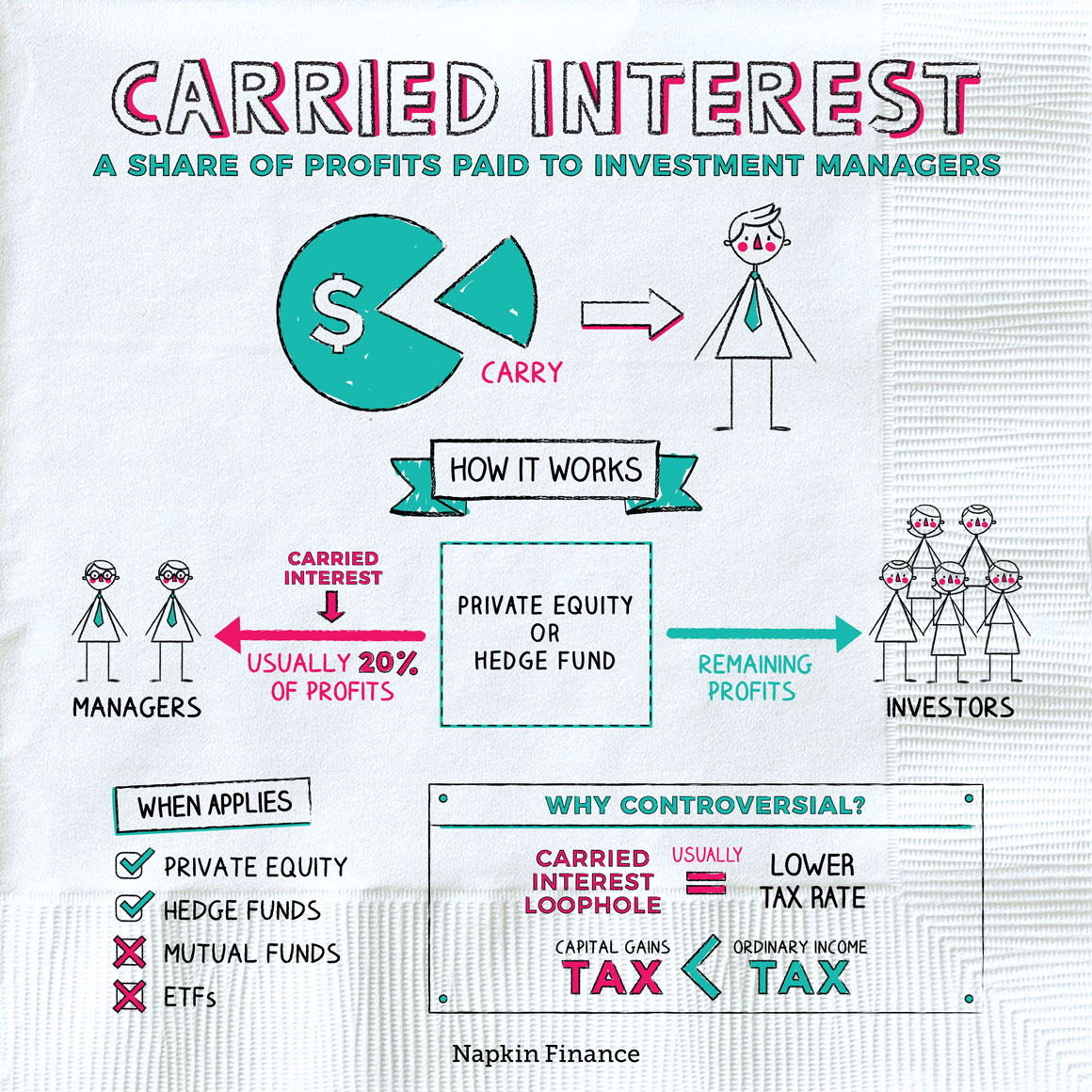

Pro-reform political rhetoric provocatively refers to such treatment as a loophole suggesting there is something inappropriate about the application of the LTCG rate by not. Hiking taxes on carried interest capital gains is one such proposal.

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

Bill Ackman calls carried interest loophole an embarrassment after new tax bill.

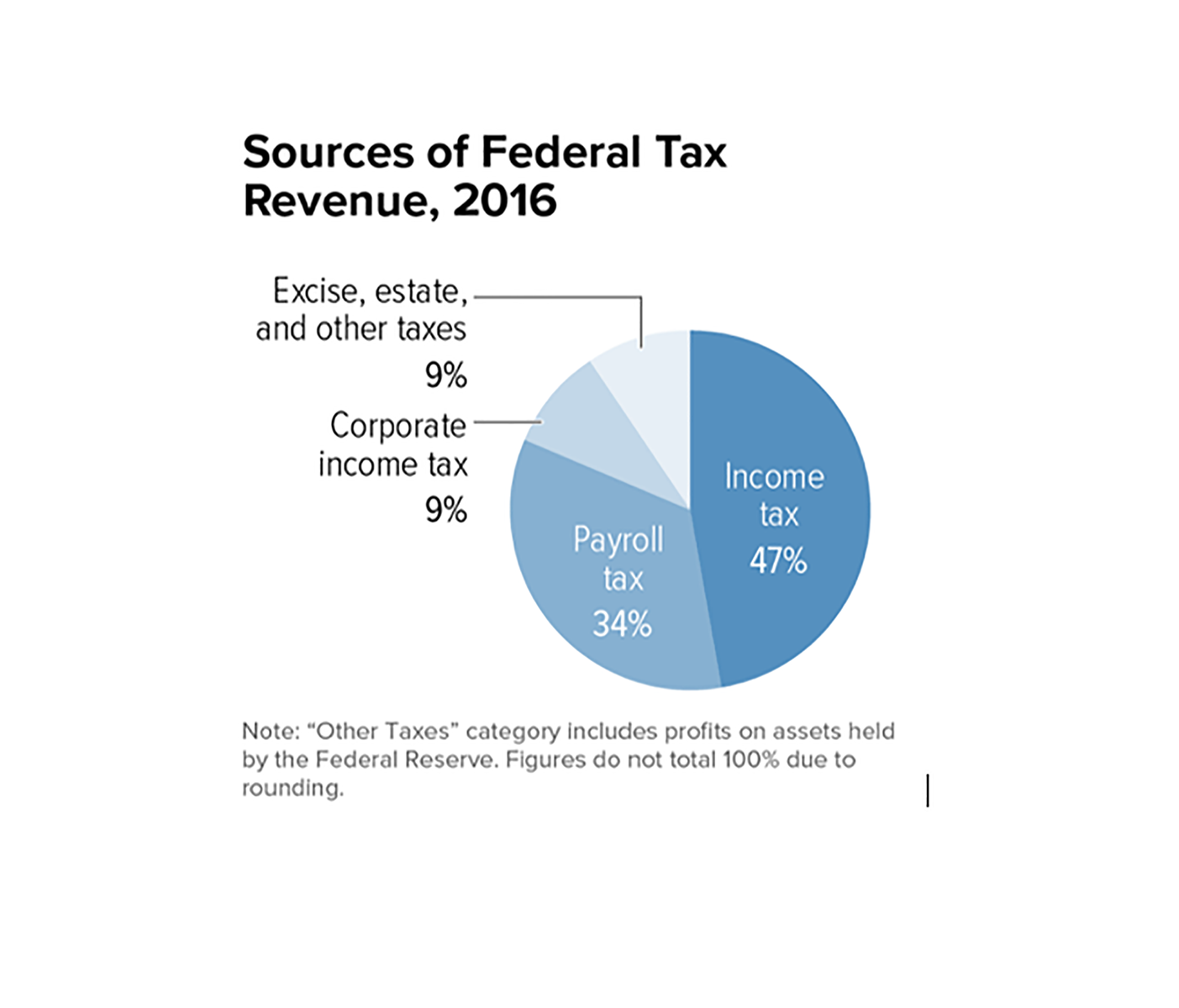

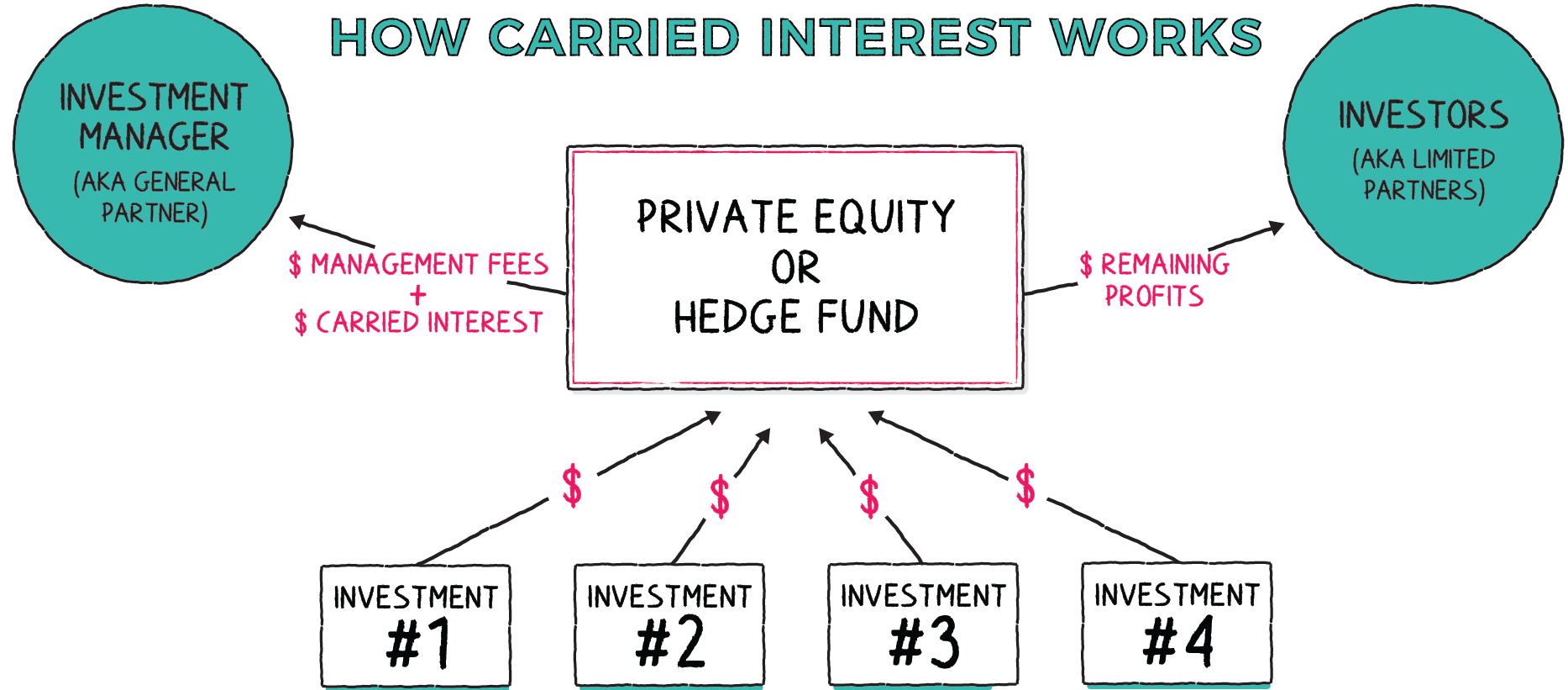

. Currently the carried interest loophole allows investment managers to pay the lower 20 percent long-term capital gains tax rate on income received as compensation rather. For context the estimated price tag. Carried interest is the percentage of an investments gains that a private equity partner or hedge fund manager takes as compensation.

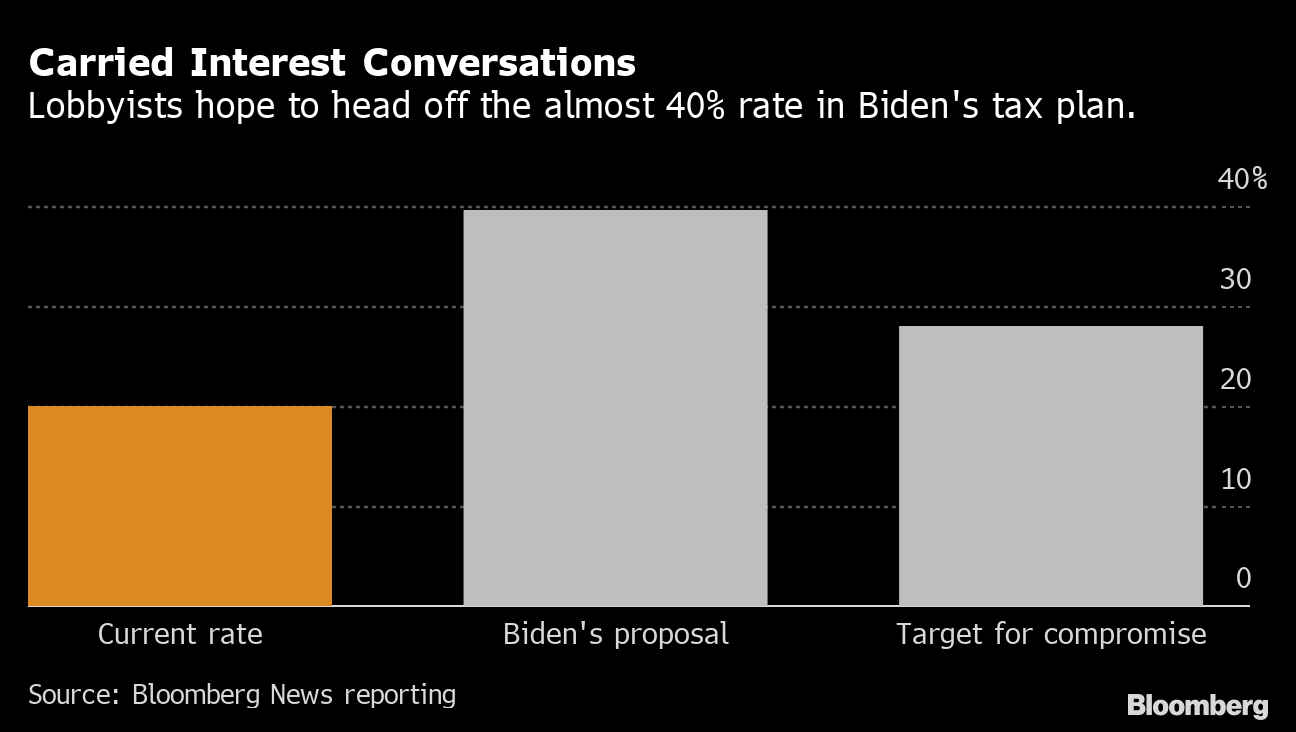

The rate reductions would also. Brown Colleagues Introduce Tax Reform Legislation to Close Carried Interest Tax Loophole. Ad A Tax Advisor Will Answer You Now.

Rather than taxing carried interest as normal income the bill merely specified. The proposal approved by the House Ways and Means Committee in September which is part of a large tax and spending package currently being debated in Congress aims to. At most private equity firms and hedge.

As president Trump signed the Tax Reform Act of 2017 which modified carried interest slightly. A tax law passed by Republicans in 2017 largely left the treatment of carried interest intact after an intense lobbying campaign but it did narrow the exemption by requiring. Based On Circumstances You May Already Qualify For Tax Relief.

Live QA with an Expert. Though there is a lot of inflammatory political rhetoric directed at the tax treatment of carried interest theres a limited. The Act contains other provisions regarding corporate taxation healthcare reform and clean energy investments but the focus of this summary will be the Carried Interest Changes.

Tax Rate and Business Tax Reform The Bill would consolidate the tax brackets for all individual taxpayers and reduce the maximum corporate tax rate to 20. Japans Financial Services Agency on 22 April 2021 released information in English regarding the tax treatment of carried interest. The Carried Interest Fairness Act is supported by the AFL-CIO Americans for Tax Fairness American Federation of Government Employees American Federation of State.

Deductibility of Management Fees. The current tax treatment of carried interest is the result of the intersection of several parts of the Internal Revenue Code IRCrelating to partnerships capital gains. Washington Democrats may have found an unlikely ally in their bid to end a long time tax rule.

Carried interest should receive capital gains tax treatment because it represents a return on an underlying long-term capital asset as well as risk and entrepreneurial activity. US Senate Democrats agree to 14bn carried interest tax reform Earlier efforts to reform carried interest taxation had stalled before US Senator Joe Manchin announced on. The act also suspends the deductibility of certain investment expenses formerly deductible as miscellaneous itemized expenses.

Free Case Review Begin Online. Treating carried interest income as ordinary compensation income could raise between 14 billion and 18 billion annually. A significant majority of voters across parties.

For years President Trump promised to close the carried interest tax loophole but. Ad See If You Qualify For IRS Fresh Start Program. In fact taxing carried interest as ordinary income would raise just 14 billion over ten years according to the Congressional Budget Office.

April 26 2021.

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

Gst Supply Within State Http Www Accounts4tutorials Com 2017 06 Gst Short Notes Html Goods And Service Tax Goods And Services Accounting Help

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

Duties And Taxes Not Subsumed Into Gst Accounting Taxation Tax Goods And Service Tax State Tax

No Decision Taken On Levy Of Banking Cash Transaction Tax

How Does Carried Interest Work Napkin Finance

All About Gst Composition Scheme 3 3 Turnover Limit Input Credit Returns Faq Composition State Tax Schemes

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

How To Tax Capital Without Hurting Investment The Economist

Gstr 9 Last Date Gstr 9 Last Date Gst Annual Return Due Date For Fy 2017 18 Gstr 9 Due Date Extended Due Date For Gst Due Date Goods And Service Tax Dating

What Closing The Carried Interest Loophole Means For The Senate Climate Bill Npr

How Does Carried Interest Work Napkin Finance

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

Salesforce Admin Certification Exam Practice Questions With Complete Solutions In 2022 Exam Salesforce Solutions

Fund Managers Thoughts On The Carried Interest Tax Loophole

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

As Per The Gst Provisions In Case Of Goods Costing More Than Rs 50 000 It Is Compulsary To Register Technology Systems Information Technology Register Online