estate trust tax return due date

Depending on the type of trust the due date of the final trust is one of the following. Estimated Payments for Taxes.

Income Tax Accounting For Trusts And Estates

WASHINGTON Victims of Hurricane Ian that began September 23 in Florida now have until February 15 2023 to file various individual and.

. The first payment for a calendar year filer must be filed on or. In one calendar year you have to file a T3 return the related T3 slips NR4 slips and T3 and NR4 summaries no later than. Failed to file fiduciary return on the date or dates prescribed.

31 rows Generally the estate tax return is due nine months after the date of death. FL-2022-19 September 29 2022. Trust tax return due date.

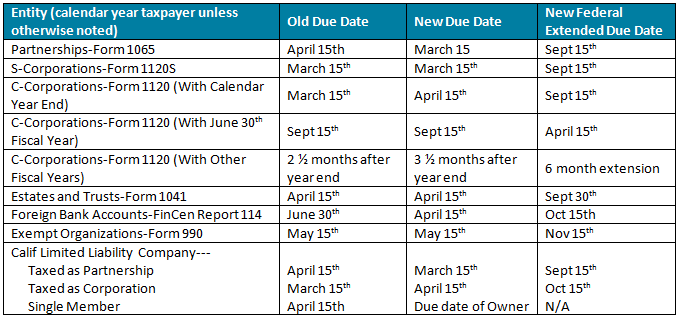

In case of Partnerships and S-Corporations the due date for filing will be 15th of the third month post completion of their tax year. Some trusts must choose a calendar tax year. There will be no change in the filing date in case.

Trusts and estates are required to file this form with the IRS four months and 15 days after the close of the tax year. Federal estate tax returns are due no later than 9 months. Estimated a tax of less than 90 percent of the developed tax shown on.

Due dates Mailing addresses Trusts When filing a trust return the trustee follows the due dates for individuals. When filing an estate return the executor follows the due dates for estates. Estates or trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trusts or estates tax year.

For example for a trust or estate with a tax year ending December 31 the due date is April 15 of the following year. For fiscal year estates and trusts file Form 1041 by the. For example for a trust or estate with a.

For the upcoming April 15 2021. Due Dates Annual Tax Returns. Due on the 15th day of the 4th month after the tax year ends.

Due Date for Estates and Trusts Tax Returns The return is required to be filed on or before April 15 if on a calendar year basis and on or before the 15th day of the fourth month following the. Graduated Rate Estate GRE due date is 90 days from the date of final distribution of its. The due date of the estate tax return is nine months after the decedents date of death however the estates representative may request an extension of time to file the return for up to six.

Failed to pay the installment or installments when due. For trusts operating on a calendar year this is April 15. The federal fiduciary income tax return is typically due by the 15th day of the 4th month following the end of the estates taxable year.

The due date of the estate tax return is nine months after the decedents date of death however the estates representative may request an extension of time to file the return. For calendar year estates and trusts file Form 1041 and Schedule s K-1 on or before April 15 of the following year. For a T3 return your filing due date depends on the trusts tax year-end.

The first step is to pick a closing date for the trusts tax year known as the trust year-end. As long as you file Form 7004 on or before your deadline the IRS should automatically grant your trust or estate additional time to file. If your trust is set up on a fiscal year.

Reporting Excess Deductions on Termination of an Estate or Trust on Forms 1040 1040-SR and 1040-NR for Tax Year 2018 and Tax Year 2019 --10-JUL-2020 Limitation on business losses for. According to the IRS estates and trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trusts or estates tax year 7 Usually the calendar year. Suppose the grantor dies July 14.

Deceased Estate Trust Tax Return Trt Form Lodgeit

Mohmedrizwanali S Profile Freelancer

Tax Returns Payment Due Dates Brenner Global Associates Llc

.png?sfvrsn=34046ffe_3)

Iras Tax Season 2022 All You Need To Know

Certain Federal And Texas Tax Return Filing And Payment Due Dates Extended Graves Dougherty Hearon Moody

Unexpected Tax Bills For Simple Trusts After Tax Reform

Best Tax Software For Estates And Trusts Form K 1 And 1041

Don T Be Surprised By New Tax Filing Due Dates San Jose Cpa Firm

/184283932-56a044915f9b58eba4af9970.jpg)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Estate Tax Returns Estate Planning Estate Settlement The American College Of Trust And Estate Counsel

Trust Tax Preparation Abtaxhelp

Application For Extension Of Time To File An Oklahoma Income Tax Return Forms Ok Gov Oklahoma Digital Prairie Documents Images And Information

2021 Us Tax Deadlines 2020 Tax Year Us Tax Financial Services

File Or Extend A Complete List Of 2020 Tax Deadlines Smallbizclub

Calameo Irs Form 7004 Automatic Extension For Business Tax Returns

Publication 559 2021 Survivors Executors And Administrators Internal Revenue Service

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate